We are a digital agency helping businesses develop immersive, engaging, and user-focused web, app, and software solutions.

2310 Mira Vista Ave

Montrose, CA 91020

2500+ reviews based on client feedback

What's Included?

ToggleRecently, Talkspace, Inc. (NASDAQ: TALK), a prominent player in the online therapy space, received an “Equal Weight” rating from Barclays. For those not fluent in Wall Street speak, this essentially translates to a neutral stance. Barclays isn’t advising investors to rush out and buy Talkspace shares, nor are they suggesting a mass exodus. They’re playing it cool, suggesting the stock is likely to perform about as well as the average stock in its sector. But what does this mean for Talkspace, the broader telehealth industry, and, most importantly, people seeking accessible mental healthcare?

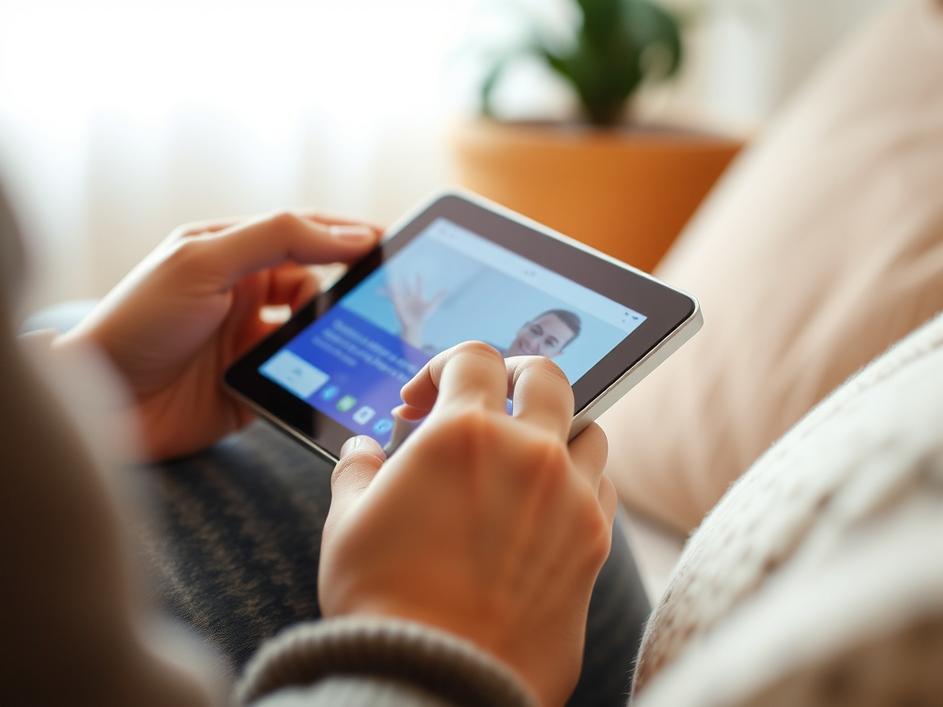

Talkspace has carved out a significant niche in the mental health market. It offers a platform connecting users with licensed therapists through messaging, video, and audio. This accessibility is a major selling point, especially for those who live in areas with limited access to traditional therapy or who have scheduling constraints. And the convenience factor can’t be overstated. No commute, no waiting rooms – just therapy from the comfort of your own home. However, the “Equal Weight” rating suggests that Barclays sees both opportunities and challenges for Talkspace.

The telehealth industry, in general, has experienced significant growth, especially since the start of the COVID-19 pandemic. People are more comfortable than ever with virtual healthcare, and the demand for mental health services has surged. But the field is also becoming increasingly competitive. Many companies are vying for a piece of the pie, from established players to innovative startups. For Talkspace, this means navigating a crowded market while demonstrating a clear value proposition to both consumers and investors. One major challenge is convincing users that online therapy is just as effective as traditional in-person sessions, a perception that some are still hesitant to embrace. Another challenge is navigating the complex web of insurance coverage and reimbursement rates. And the cost of marketing to acquire new users in a competitive market is high, impacting profitability. On the opportunity side, Talkspace can capitalize on the growing awareness of mental health and the increasing acceptance of telehealth. They can also expand their services to address specific needs, such as anxiety, depression, or relationship issues. Furthermore, there’s potential for partnerships with employers and health plans, providing mental health benefits to a broader population.

Barclays’ neutral rating suggests a wait-and-see approach. Talkspace has a solid foundation, but it needs to demonstrate sustainable growth and profitability to win over more enthusiastic investors. The company’s ability to innovate, differentiate itself from competitors, and effectively manage its costs will be crucial factors in its future success. Talkspace needs to improve its financials. While revenue growth is important, keeping costs low and becoming profitable is even more important. Investors will be watching for Talkspace to manage marketing expenses. Therapy platforms such as Talkspace need to show they can be profitable.

Ultimately, the success of companies like Talkspace has significant implications for mental healthcare access. If these platforms can provide affordable, convenient, and effective therapy, they can help bridge the gap in services and reach individuals who might otherwise go without care. This is particularly important for underserved populations, such as those in rural areas or those with limited financial resources. Mental healthcare is no longer a luxury; it’s a necessity. And by making therapy more accessible, Talkspace and other telehealth companies can play a vital role in improving the well-being of individuals and communities. Although it is vital to maintain the human element of the experience and remember that telehealth should be used to augment – not replace – traditional face to face therapy. Careful monitoring of the effectiveness of telehealth and comparisons to traditional measures are critical to maintaining the quality of care.

Barclays’ “Equal Weight” rating on Talkspace reflects a balanced perspective. Talkspace holds a respected position in the telehealth market, but the company must still navigate the hurdles of competition and profitability. The market awaits sustained growth and innovation from Talkspace, but this rating highlights the need for the company to keep striving to improve accessibility to the valuable service of mental healthcare.

Comments are closed