We are a digital agency helping businesses develop immersive, engaging, and user-focused web, app, and software solutions.

2310 Mira Vista Ave

Montrose, CA 91020

2500+ reviews based on client feedback

What's Included?

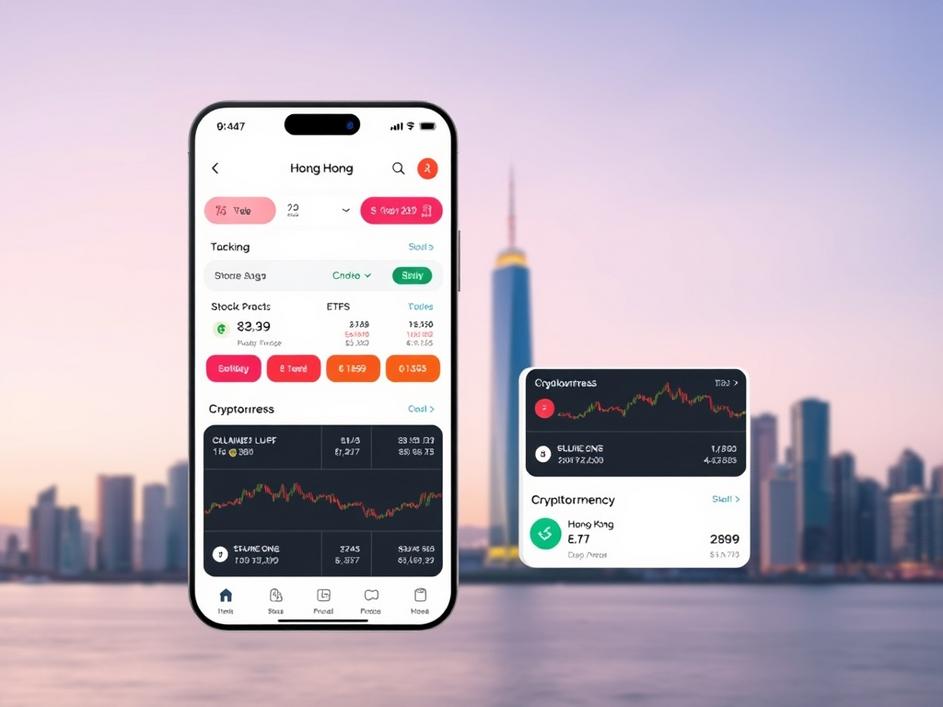

ToggleSoFi, the well-known personal finance company, is making a significant leap into the global market, starting with Hong Kong. They’re teaming up with OSL, a major player in the digital asset space, to launch an all-in-one investment app. This marks SoFi’s first venture into offering cryptocurrency services outside of the United States, signaling a big step in their international expansion strategy. This move isn’t just about offering crypto; it’s about creating a comprehensive investment platform tailored to the Hong Kong market, a region with a strong interest in both traditional finance and digital assets.

The new app aims to provide a seamless and integrated experience for users. It will allow them to invest in a variety of assets, including stocks, ETFs, and, of course, cryptocurrencies. The collaboration with OSL is key here, as it brings the necessary infrastructure and regulatory compliance for offering crypto trading in Hong Kong. This means users can buy, sell, and hold digital assets within the same platform they use for their other investments. The key selling point is convenience and accessibility, bringing a range of investment options to users in one place.

Hong Kong is a strategic choice for SoFi’s first global crypto expansion. The city has a vibrant financial market and a growing interest in digital assets. Also, Hong Kong is actively working to position itself as a hub for fintech innovation and virtual assets. By launching here, SoFi can tap into a tech-savvy population and a regulatory environment that is becoming increasingly supportive of the crypto industry. This move could give SoFi a significant advantage as they look to expand further into other Asian markets.

The partnership with OSL is crucial for SoFi’s success in Hong Kong. OSL brings a wealth of experience in the digital asset space, particularly in navigating the complex regulatory landscape. They are licensed by the Hong Kong Securities and Futures Commission (SFC), which means they can legally offer crypto trading services in the region. This partnership allows SoFi to offer crypto services in a compliant and secure manner, building trust with users and regulators alike. Without a partner like OSL, entering the Hong Kong crypto market would be significantly more challenging.

SoFi isn’t the only company eyeing the Hong Kong market. There are already several established players in the online brokerage and crypto exchange space. However, SoFi’s all-in-one approach, combined with its brand recognition and user-friendly platform, could give it a competitive edge. The success of this venture in Hong Kong could pave the way for SoFi to expand its services to other countries in Asia and beyond. It will be interesting to see how they adapt their offerings to meet the specific needs of different markets. This move also puts pressure on other fintech companies to expand their services and offer more comprehensive investment solutions.

While the initial focus is on integrating crypto into the investment app, SoFi’s long-term vision likely extends beyond just digital assets. The company has a history of offering a wide range of financial products, including loans, insurance, and financial planning services. Over time, we can expect SoFi to integrate these offerings into its Hong Kong platform, creating a truly holistic financial solution for its users. This strategy could differentiate SoFi from its competitors and attract a broader customer base.

Despite the opportunities, SoFi faces several challenges in the Hong Kong market. Regulatory compliance is an ongoing process, and the rules governing digital assets are constantly evolving. SoFi will need to stay agile and adapt to these changes to ensure they remain compliant. Additionally, they will need to compete with established players who already have a strong foothold in the market. Building brand awareness and acquiring customers will require significant investment in marketing and customer acquisition. And let’s not forget the ever-present risk of cybersecurity threats, which is a major concern for any company handling financial assets.

SoFi’s expansion into Hong Kong represents a significant step in its journey to become a global financial platform. By partnering with OSL and offering an all-in-one investment app, they are well-positioned to capitalize on the growing interest in digital assets in Asia. While challenges remain, the potential rewards are significant. This move could not only expand SoFi’s reach but also drive innovation in the financial services industry as a whole. The next few years will be crucial in determining whether SoFi can successfully replicate its success in the US in the highly competitive Hong Kong market. It’s a bold move, and one that could reshape the landscape of online investing in Asia.

Comments are closed