We are a digital agency helping businesses develop immersive, engaging, and user-focused web, app, and software solutions.

2310 Mira Vista Ave

Montrose, CA 91020

2500+ reviews based on client feedback

What's Included?

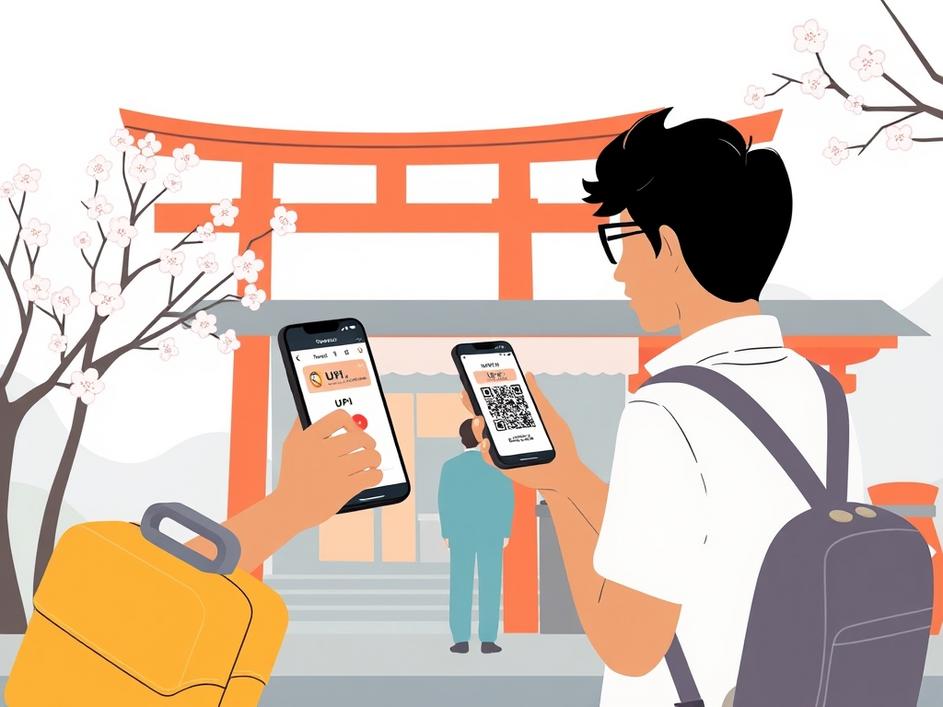

TogglePicture this: you’ve finally saved up for that dream trip to Japan. You’re imagining cherry blossoms, bullet trains, and delicious sushi. But then, a familiar worry creeps in. How will you pay for everything? Do you carry a wad of yen? Will your credit card work everywhere? What about those annoying foreign transaction fees? For years, managing money while traveling internationally has been one of the biggest headaches. You either pay hefty exchange rates, search for ATMs that accept your card, or worry about losing cash. It’s a small but constant stress that can take away from the joy of exploring a new place. Well, if you’re an Indian traveler, get ready for some truly fantastic news. That familiar, trusty UPI app on your phone, the one you use every day for everything from groceries to splitting bills with friends, is about to become your new best friend in the Land of the Rising Sun. This isn’t just a minor convenience; it’s a game-changer for how Indians will experience Japan.

For those living in India, UPI isn’t just a payment method; it’s practically a way of life. It’s incredibly fast, super easy to use, and lets you pay instantly with just a few taps on your phone. From street vendors to big malls, UPI has made digital transactions effortless. Now, imagine taking that same ease and familiarity with you on your international adventures. That’s exactly what’s happening in Japan. Soon, Indian visitors will be able to simply scan a QR code at participating shops and restaurants using their existing UPI app and pay in Indian Rupees, with the merchant receiving Japanese Yen. This means no more fumbling with foreign currency, no more worrying about carrying large amounts of cash, and crucially, you get to skip a lot of the usual foreign exchange costs and credit card fees. It truly removes a significant layer of stress, letting you focus on enjoying your trip, whether that’s exploring ancient temples in Kyoto or shopping for anime merchandise in Tokyo. It’s about bringing the comfort of home right into your travel experience.

This move isn’t just about making life easier for travelers; it’s a huge statement about India’s growing influence in the global digital economy. NPCI International, the global arm of the organization behind UPI, has been working tirelessly to take this successful payment system beyond India’s borders. We’ve already seen UPI adopted in places like Singapore, Bhutan, Nepal, and the UAE, but Japan is a significant step up. Japan is a major economic power and a highly popular tourist destination. Its adoption of UPI shows a real recognition of the system’s robustness and efficiency. This expansion reflects India’s ambition to become a leader in digital payments, offering a secure, low-cost alternative to traditional international payment networks. It’s about India exporting its innovation and making life simpler for millions, while also strengthening ties and making it easier for people to do business and travel between countries. This isn’t just about money; it’s about connecting cultures and economies in new ways.

From Japan’s perspective, welcoming UPI makes a lot of sense. India is a massive and rapidly growing source of international tourists. Making payments easier for Indian visitors could significantly boost tourism numbers and spending in Japan. Local businesses, especially those in popular tourist areas, will find it much easier to serve Indian customers without needing to invest in complex new payment terminals. They simply need to display a QR code. While it will likely start with select merchants, the success of UPI in other countries suggests that adoption could spread quickly, especially once merchants see the benefits. This also puts Japan on the map as a forward-thinking country when it comes to adopting diverse payment technologies. For Indian travelers, it opens up a whole new world. They might feel more confident traveling to Japan, knowing that their money is easily accessible and spending won’t be a hassle. It could even pave the way for other countries to consider integrating UPI, further globalizing this made-in-India payment solution.

The introduction of UPI in Japan is more than just a payment update; it’s a peek into the future of international travel and commerce. Imagine a world where your domestic payment app works almost everywhere you go, making cross-border transactions feel as simple as paying your local coffee shop. While the initial rollout will be at ‘select merchants,’ which is a natural starting point, the potential for wider adoption is immense. Of course, there will be a period of adjustment. Merchants in Japan will need to understand the system, and travelers will need to know where they can use it. But given the clear advantages for both sides, these initial hurdles are likely to be overcome quickly. This development sets a powerful precedent, challenging traditional payment giants and paving the way for a truly interconnected global financial system driven by user-friendly, real-time payment solutions. It makes you wonder which country will be next to welcome UPI, further shrinking our world in the best possible way.

So, the next time you’re planning that incredible trip to Japan, you can check one major worry off your list. The days of currency exchange woes and foreign transaction fee anxiety are quickly fading. Your trusty UPI app is ready to accompany you, making your journey smoother, more enjoyable, and truly seamless. This isn’t just a win for Indian travelers; it’s a testament to India’s growing technological prowess and its vision for a more connected and convenient global future. Get ready to scan, pay, and explore Japan with unprecedented ease!

Comments are closed